Ongoing Coverage [STOCK: XPEL]: Q3 Earnings Update

Hello Capital Light readers!

Today, we’re updating my thoughts on Xpel.

But first, I want to share an excerpt from a recent article about Portfolio Manager Henry Ellenbogen on finding excellent businesses early. Ellenbogen’s funds have compounded at rates significantly above their benchmarks. I believe this is particularly relevant toXpel shareholders over the last several years.

Xpel: Transition from a Growth Story to a Margin and Growth Story

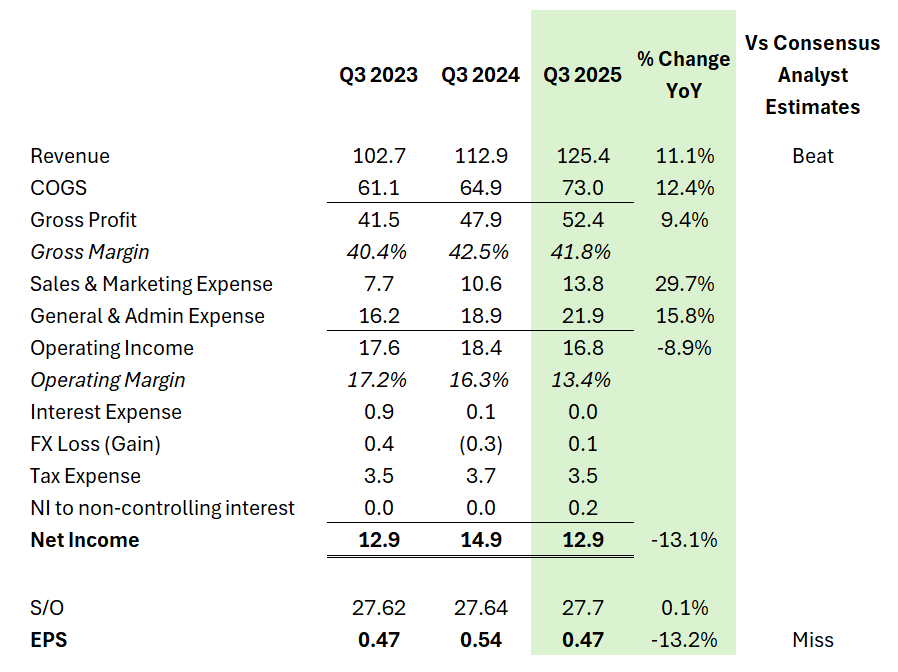

Xpel reported earnings for Q3 that beat expectations on revenue, but missed on net income and EPS. The revenue number was particularly strong, coming in at $125M vs analysts at just $119M, but margins were lower than expected resulting in EPS of $0.47 vs analysts at $0.52.

Guidance for Q4 revenue came in at $123-125M, well above analyst expectations of $116M. Xpel acquired the Chinese distributor during Q3, which will show up in Q4’s revenue number (this is accounted for in the guidance).

Cash flow and the balance sheet are a bit messier due to some complications with the Chinese distributor acquisition. A little over $23M of other short-term liabilities now shows on the balance sheet, consisting of $12.5M of contingent consideration (representing the value of inventory acquired that may be sold above it’s net realizable value) and $10.9M of acquisition holdback payments. A further $12.6M of other long-term liabilities now shows, also related to the acquisition. Quite frankly, I’m far from having the ability to explain this, so I’ll simply pull Barry Wood’s (Xpel CFO) explanation from the call:

I thought it’d be useful to give a brief overview of the structure of the China transaction given its complexity. We -- first, we formed a new entity in which we have a 76% interest. This new entity then acquired the assets of our Chinese distributor. The purchase consideration for this totaled just under $53 million before discounting for time value of money. And there are essentially 3 components to the consideration. First, obviously, there was a cash upfront. Second, there was deferred consideration or really cash payable over a 4-year period. And thirdly, there was consideration contingent on future sales of what we considered as excess inventory as of the close date. This excess inventory was part of the inventory acquired and the contingency is structured such that we pay some consideration if the excess inventory is sold at a profit, but we effectively are not penalized if any of the excess inventory is sold at a loss or has never sold and needs to be written off.

As Ryan mentioned, in the overall transaction, we effectively added approximately $22 million in inventory if you consider inventory acquired and inventory contributed by minority holders. The first 2 items, the cash upfront and the deferred consideration are about 75% of the total consideration. And for various customary legal reasons unique to the transaction, only a portion of the cash paid upfront was actually remitted and the rest of the upfront payment will be paid very soon. And this is important to understand when you look at our balance sheet as we’ve broken these components out there. The remaining upfront payment still payable and the contingent consideration is reflected in the short term.

And other short-term liabilities on the balance sheet. The deferred consideration, the cash payable over a 4-year period is reflected in other long-term liabilities. So as Ryan mentioned, we’re certainly happy to get this deal behind us. It was somewhat a complicated deal, and there was a lot of hard work done by several people to make this happen. We have a great team in the region, and we are really looking forward to watching them grow that market.

Barry Wood, CFO - Xpel Q3 2025 Earnings Call

The accounting is one thing, but less widely understood are the implications of Xpel’s Chinese distributor acquisition. Over the last five years, Xpel has deployed a strategy of going direct in most major car markets around the world, primarily by acquiring distributors. This strategy allows Xpel to get “closer to the customer” (a company slogan) and have more control over the entire ecosystem. Xpel’s direct market approach has proven successful. In nearly every market, they’ve made significant growth progress within a year or two of going direct or acquiring direct distribution. France, Australia, Japan, India, and Thailand are all markets where Xpel has recently deployed this strategy. Of course, the US and Canada are Xpel’s most successful flagship geographies, where Xpel has always been direct.

China is the most significant market for Xpel outside of North America. It is the company’s third largest source of revenue after the U.S. and Canada. But growth has largely stalled out since 2020 due to a varied combination of factors. Competition in China stealing Xpel’s IP, strict COVID-related restrictions in China, lumpy distributor orders, a general slowing of the Chinese economy, a lack of investment for in-country training resources, and a premium product that wasn’t precise enough for the Chinese market.

Many of the problems within Xpel’s control have been addressed. They’ve been aggressively investing in better training in Asia. In 2024, Xpel renewed its Xpel China product line, introducing a more affordable film. They’ve also defended their intellectual property and even convinced the distributor to optimize order timing, significantly reducing the lumpiness of shipments. This distributor acquisition is the final key to unlocking a renewed China growth strategy, giving Xpel complete market control.

Xpel also revealed in the Q3 earnings report that they will be bringing manufacturing of their films in-house over the next three years. This will require investing $75-150M in new manufacturing capabilities. Long-term shareholders have speculated about this for many years. There are advantages that Xpel has received from using external suppliers - the ability to maintain an extraordinarily capital light model is perhaps the greatest of these - but as Xpel has grown, it has perhaps outgrown these advantages as well. If Xpel wants to get bigger without relying on external partners, this investment is necessary.

Xpel management stated on the call that by investing in manufacturing, gross margins could climb to the mid-50s, and operating margins could climb into the high 20s by as soon as 2028. This would nearly double today’s margins.

The stock has reacted positively, rising to the low $50s for the first time since early 2024. I have to admit some surprise by the strong reaction given earnings were down significantly in the quarter, but a mix of optimism around good guidance, the manufacturing announcement, and small caps finding favor have propelled the share price higher. We may have finally turned a corner on the stock price. I don’t see this momentum fading much in the current environment.

Thumbnail Image: Cory Rogers

Disclosure: Accounts I manage are long Xpel Inc (NASDAQ: XPEL).

Disclaimer: This post and all Capital Light posts are not financial advice in any way and should not be taken as such. All articles, including this one, and all information within Capital Light are for educational and informational purposes only. I receive no direct compensation from any company covered. I will likely profit in the event the share price of companies covered increases and I have a long position. I will likely profit in the event the share price of companies covered decreases and I have a short position. Although I make an effort to update readers when possible, I may choose to buy or sell at any time with no obligation to update or notify readers. Consult a professional financial advisor before making any investment decisions.