Kneat: A Capital Light Smallcap SaaS Business You Can't Ignore - Part 1

Kneat is a software business dominating the Life Sciences validation software niche with a signficant opportunity to become the premier enterprise solution.

Today, I’m writing about a capital-light smallcap SaaS business that has carved out a unique position in the Life Sciences industry with little competition.

This business has the following characteristics:

The company has grown sales 10X from 2019 to the last twelve months (>50% CAGR).

The company’s TAM is significantly larger than its current revenue. I am confident this business can continue to grow the top line at a 20%+ CAGR for many more years.

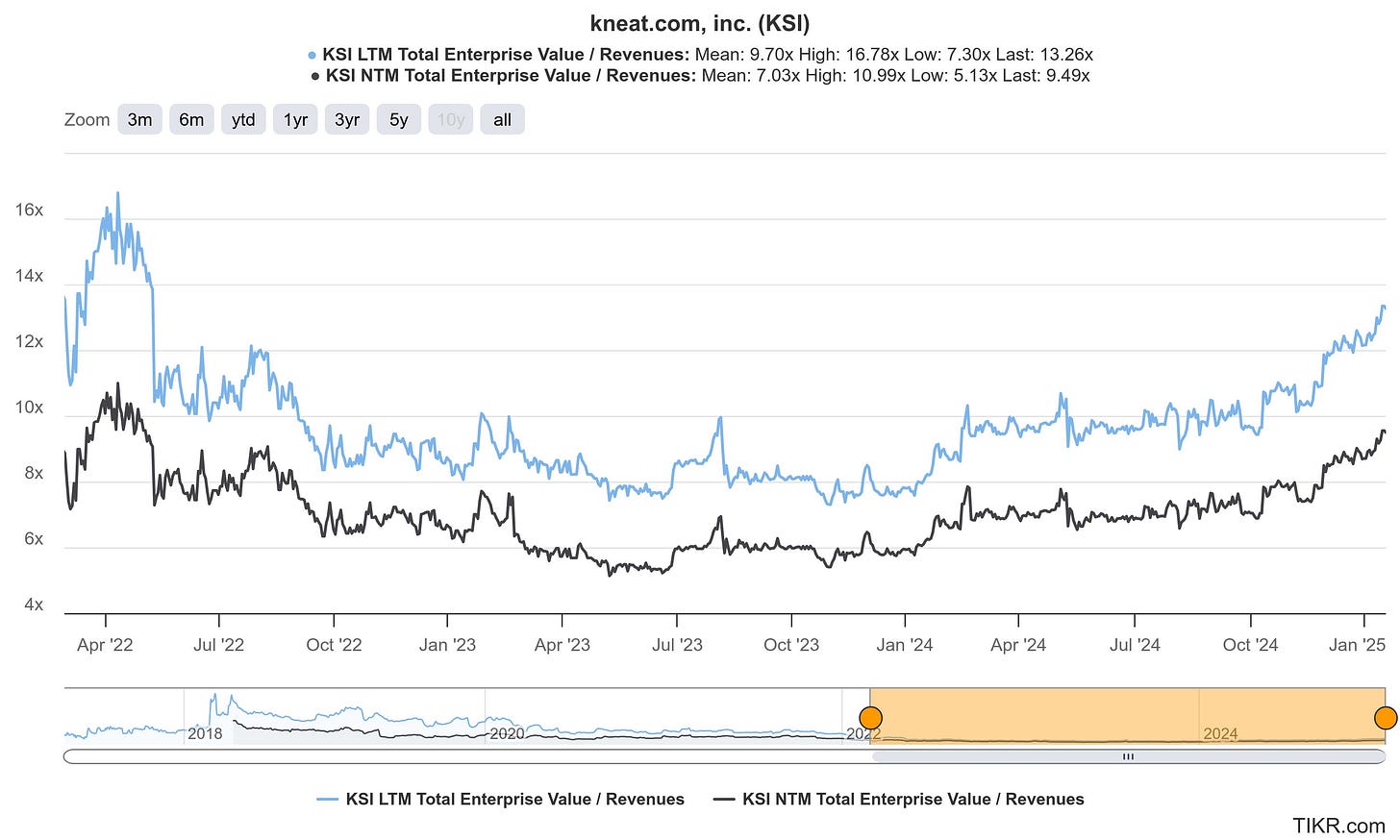

The stock currently trades at around 9X NTM EV/S, meaning it is not cheap on an absolute basis, but given its growth, one can likely justify a premium valuation.

The business is nearing a profitability inflection point with Q3 2024’s results near operating break-even after years of negative operating income.

The business likely has strong future pricing power but is currently pursuing a land-grab strategy to capture greenfield customers first.

Once the business has captured customers, they’re likely to be extremely sticky, as switching costs are likely to be very high given the sensitive nature of the software’s applications.

Customers include many of the largest Life Sciences companies in the world.

If the business were to trade near 6X to 7X NTM EV/S, I would likely be interested in initiating a position. It traded near this valuation in 2022, 2023, and early 2024.

I believe there is long-term permanent multiple expansion potential as the company grows into a size where more institutional investors can begin to buy in.

This is precisely the type of business that investors should get to know ahead of time, so that they can be prepared when the business goes on sale.

Even from today’s valuations, I think investors stand a reasonable chance of doing well, though unexpected declines in growth could result in a considerable stock price decline at the current valuation.

Table of Contents:

Part 1:

Brief Business History & Business Model

Competitive Analysis & Industry Positioning

Competitive Environment

Competitive Advantages & Moat

Key Risks

Part 2:

Financial Model, Assumptions, & Valuation

Management & Capital Allocation

Questions Not Yet Answered

Conclusion

Business History & Business Model

Kneat.com (TSE: KSI, market cap $600M CAD) is a founder-owner-led Life Sciences niche software business in the validation space headquartered in Ireland, but trading on the Toronto Stock Exchange in Canada. The company was established in 2007 by its current Chief Executive Officer (CEO), Edmund Ryan, and Chief Product Officer (CPO), Kevin Fitzgerald. Edmund Ryan, with a background in engineering, started his career in the pharmaceutical sector where he met his future co-founder, Kevin Fitzgerald. Together, they identified a critical gap in the Life Sciences sector: the absence of a robust digital solution for validation lifecycle management and testing required to meet stringent regulatory standards.1

Before Kneat, companies had to rely on paper-based processes for validation. Many still do today. Reliance on paper-based processes can lead to inefficiencies, lost documentation, and compliance risks. This realization inspired the founding duo to develop what would eventually become the Kneat Gx cloud-based software platform. Kneat’s software digitizes validation so companies can increase inefficiency, ensure they meet compliance regulations, provide records for audits, and aren’t risking physical destruction or loss of paper documents.

Regulators around the world (such as the FDA in the United States) require companies in the Life Sciences industry (think pharma, biotech, and medical devices) to document and record all aspects of development, research, and manufacturing of products. This process is known as “Validation”. The process of validation ensures that products meet a set of high-quality standards known as Good Manufacturing Processes (“GMP”) as well as various other regulatory requirements. Validation includes the following:2

Types of validation:

ProMcess Validation: Ensures processes result in products that consistently meet high-quality standards.

Cleaning Validation: Ensures that equipment is properly cleaned and free from contamination.

Computer System Validation: Ensures software and computerized systems used in processes operate correctly and reliably.

Equipment Validation: Demonstrates that equipment is performing as intended.

Analytical Method Validation: Verifies that methods used to test products are accurate and reproducible.

Stages of Validation:

Installation Qualification (IQ): Confirms that equipment or systems are installed according to design specifications.

Operational Qualification (OQ): Verifies that systems operate correctly within specified parameters.

Performance Qualification (PQ): Ensures systems consistently perform according to intended use in real-world conditions.

Traditionally, companies have met these validation standards via old-school paper trails. While this works, it’s inefficient, cumbersome, and susceptible to destruction via physical risks such as fire, flood, vandalism, or even theft. Colleagues may find it difficult to share documents when necessary. Getting various approvals and signatures requires team members to be physically present. Audits using physical paper may delay projects. Even something as simple as the storage of paper documents can become a costly problem. Ultimately, the largest potential cost to a Life Sciences company could be non-compliance, which may result in fees or fines, lost revenues, and loss of trust.

Thus, Kneat’s value proposition aims to solve this by bringing these documents to a digital platform that ensures compliance, eliminates physical storage needs, protects against physical risks, lowers costs, and enables efficiency.

Revenue Generation

Kneat generates revenue from three distinct revenue streams and one discontinued revenue stream: SaaS license fees, maintenance fees, professional services, and on-premise license fees (discontinued and transitioned to SaaS). SaaS license fees dominate, making up about 90% of 2024 revenue, while Professional services & other generates most of the remaining 10%. Maintenance Fees only generate about 0.5% of revenue as of 2024. On-premise revenues in 2024 will be recorded as $0, as on-premise has been discontinued, and all but one customer has replaced it with the SaaS offering.

Customers generally sign initial 3-year contracts with Kneat, paying for one year upfront at a time. SaaS revenue is then recognized over the life of the contract. This means Kneat collects significant cash at the time of contract initiation and subsequent annual renewals. Maintenance fees are charged on on-premise licenses for updates and technical support services on a similar upfront payment model (it appears this may also be discontinued once the final customer moves over to SaaS). Professional services & other revenue include revenue from consulting, training, process mapping, project management, and other services that are distinct from the sale of licenses.3

Deployment for new customers typically takes 3 to 6 months, depending on the complexity of the implementation. These licenses are often initiated for one validation use case at one site but include options for the customer to purchase additional licenses. This allows Kneat to start small with new customers, prove its value proposition, and then scale quickly as the customer recognizes the software’s value.

Total Addressable Market

There are two key questions investors in Kneat need to ask regarding how much potential this company has, which ultimately informs future estimated growth rates:

What is the Total Addressable Market (“TAM”) for validation software in Life Sciences?

Can Kneat expand to other GMP industries such as manufacturing, food and beverage, or cosmetics? If so, what is the TAM of these?

Kneat states the total addressable market within Life Sciences is $2 billion4 of annual recurring revenue (“ARR”). This is 40 times larger than Kneat’s current ARR of $49.9 million. Should Kneat manage to capture 25% of this market at scale long term (not an unreasonable market share assumption for a scaled leading software company), the revenue base would be 10X larger. Thus, it remains a safe assumption that the market is large enough for Kneat to continue growing revenue at a >20% rate going forward.

Kneat also gives numbers regarding adjacent quality solutions within Life Sciences and states this as being a $7B TAM. Finally, Kneat states the TAM for new verticals exceeds $15B.

These numbers roughly align with other sources found by quickly googling the global Life Sciences software market, but it’s worth noting that TAM analyses always lack a large degree of precision.

At this stage, the point remains that Kneat’s opportunity is significant. Being overly precise here is trivial. Growing revenue at a 30% CAGR from here would take another 10 years to reach $500M in revenue (10X today’s ARR) in a market that is largely greenfield. Thus, I believe strong revenue growth assumptions going forward continue to make sense.

Competitive Analysis and Industry Position

Competitive Environment

Software is usually a highly competitive space. Generally, there is substantial competition with industry players competing to achieve the eventual benefits of scale. This requires large upfront outlays of capital spending on operational costs leading to operating losses for multiple years before eventually reaping the rewards of scale, leading to reliable recurring revenue, strong profitability, high returns on capital, and an entrenched moat.

The best software businesses can produce profitable results early on even despite large investments in operating costs. Kneat is not at profitability yet but is getting close.

Kneat is the current market leader still in the early stages of building out scale in the Life Sciences validation space. Kneat is not without competition though. Kneat faces competition from several other players. Kneat’s main competitors include the following:

Veeva Systems

Veeva Systems (NYSE: VEEV, market cap $35B) is a market leader in Life Sciences CRM software.5 Veeva’s flagship Veeva Vault platform integrates various business functions for large enterprises and is a higher-cost option with less customizability, but perhaps more familiarity. Veeva is already likely used by most large Life Sciences companies.

Veeva attempted to launch a validation offering in 2021,6 likely because Veeva began to notice companies like Kneat winning customer contracts.

As of 2024, Veeva has won less than 50 customers (likely quite a bit less given the range they state is 11-50), and considers the product mature. This is a part of the Quality Vault product offered by Veeva, although I believe customers are able to purchase the validation management component as a standalone product. It is my understanding that this product mostly addresses Computer System Validation, and not so much other types of validation.

Veeva is likely more focused on competing with Salesforce and IQVIA as the current validation market is simply too small to move the needle for a $3 billion revenue company (nearly 70 times larger than Kneat’s LTM revenue).

Investors should not ignore Veeva though, as they’re a credible competitor with significantly more resources than Kneat should they decide to more aggressively attack the validation space. Then again, Veeva could just wait to see who the eventual winner is and simply acquire them. Kneat seems like a natural fit for a Veeva acquisition.

ValGenesis

ValGenesis7 is a privately owned developer of validation software and is generally considered Kneat’s most direct competitor. My understanding is that ValGenesis is more focused on the market in India and Asia, where there are substantial pharmaceutical manufacturing operations.

My research suggests that VelGenesis is priced lower than Kneat and is generally considered a lower-quality product targeting smaller operations.8 Kneat prefers to be positioned as the more premium enterprise solution. In many industries, being the low-cost provider is a competitive advantage. However, in validation software, I would probably argue that being the low-cost provider is not the ideal industry position. One simply needs to look to other software subsectors to see that this is the case. Salesforce (NYSE: CRM), for example, is far removed from being the low-cost CRM software option, yet it’s the most-used enterprise CRM system. Enterprise customers are not usually price-sensitive, particularly when the efficiencies and cost savings gained far exceed the cost of the software. Thus, a more robust, feature-rich solution is likely preferred by larger enterprises.

Furthermore, being the low-cost software option may limit a company’s ability to make aggressive investments in the product, provide technical support, or even negatively impact a software company’s ability to raise prices.

Thanks to some MCC contributors (I am unable to share the discussion publicly), it appears that ValGenesis has an inferior product and has lost some contracts to Kneat over time, while Kneat has never lost a contract (that we know of) to ValGenesis.

Thus, while ValGenesis is likely the closest Kneat competitor today, I’m hard-pressed to think they’re a legitimate threat in the enterprise opportunity set at this time.

IQVIA Holdings

IQVIA Holdings (NYSE: IQV, market cap $36B) is a major analytics and data software player in the Life Sciences industry9. IQVIA dwarfs even Veeva with $15B of annual revenue (compared to $3B for Veeva and $45M for Kneat) though its market cap is a mere $2B more than Veeva at $36B.

IQVIA also has some validation products, but IQVIA’s main focuses are on compliance management and data analytics rather than validation lifecycle management.

IQVIA is similar in competitiveness to Veeva. Validation likely remains a market that is too small to move the needle for them, leaving room for Kneat to carve out a niche here. IQVIA could easily be another potential acquirer of Kneat down the road.

Tricentis

Tricentis10 is considered a competitor to Kneat, but is a far more general testing and automation platform addressing multiple industries, rather than a specialized Life Sciences validation offering. Tricentis’ software likely has some overlap in the testing phase of validation, but they do not address the full validation stack. Therefore, I do not consider them a credible threat at this time.

Others

There are a few more players that are either subscale or not direct competitors but may have slight overlaps in some places. Dotmatics11 is an R&D science and data software platform with some overlap. MasterControl12 is a Quality Management System (“QMS”) that helps companies with broader quality controls such as Corrective and Preventive Action (“CAPA”), audits, documents, and supply chains. Sware13 is a VC-backed validation software company focused on GxP (GMP) Validation in Life Sciences and manufacturing. Sware is small and targets smaller companies with more affordable but less scalable solutions, similar to ValGenesis.

During my research process, I came across this writeup on Kneat by Matthew Miller (@millergolfer23 on X) from 2023. I reached out to Matthew and got his permission to share his industry position chart, which I think does an excellent job of marking out the competitive landscape:

Competitive Advantages & MOAT

I tend to distinguish competitive advantages from MOATs by the following; I consider competitive advantages to be smaller advantages that tend to be somewhat temporary while MOATs are barriers that insulate companies from having their competitive advantages eroded quickly.

When a company can utilize a moat around its competitive advantages, it becomes isolated from competition succeeding at destroying its profitability and returns on capital. It appears to me that Kneat has several of both, and is in a position to be isolated from competition.

Competitive Advantages

First-mover advantage

Kneat has a first-mover advantage. First-mover advantages in software can be extremely powerful, particularly for a highly regulated and compliance-focused product. This is because first-mover advantages enable software companies to build a moat around switching costs (see Switching Costs below). Kneat needs to maintain its lead here to keep this advantage.

Scale

Kneat is in the process of building a scale advantage. Q3 2024 showed nearly breakeven operating income and some operating leverage began to kick in, suggesting that Kneat is now reaching a scale that could allow it to operate more efficiently than competitors. Competitors will likely need to continue running losses and burning cash. Nevertheless, I do expect Kneat to continue making aggressive investments to maintain the scale advantage while growing revenue by >20% annually. As such, I’m not yet confident in their ability to be profitable in the near term as they continue to build out scale.

Technology & IP

Given the competitive landscape outlined above, it appears to me that Kneat has the best technology and most capable IP for enterprise validation use cases. From what I can tell, Kneat’s platform is the most flexible and customizable. Many customers reportedly begin using Kneat’s products, discover new use cases for the products, and thus expand their licenses with Kneat. On the other hand, it can be difficult to assess technological advantages from the outside (if anyone reading this has used Kneat and/or competitor’s software, please reach out if you’re willing to share your experience using the software).

MOAT

Switching Costs

The nature of software in a highly regulated and compliance-heavy industry is such that customers will find it extremely difficult to switch to another provider in the future. This is due to all their current data, information, and files being on Kneat’s ecosystem, along with compliance and regulatory barriers that may make switching even more difficult and costly. This is ultimately a moat that will prevent new competition from winning existing customer market share (though not necessarily new customers) and permit Kneat to raise prices over time.

Network Effects

Kneat's platform uses network effects to reinforce its position in the industry. As more departments within a company adopt the software, employees become enabled to work together and communicate more efficiently.

As Kneat is adopted by more organizations, its reputation as the top enterprise validation solution continues to grow. Each new company that uses Kneat helps to bring it closer to being considered an industry standard, which may ultimately make it the default program that companies feel compelled to use.

Kneat also benefits from network effects due to software integrations with ERP, CRM, and QMS platforms. These integrations expand the platform's capabilities and versatility, allowing it to integrate more easily and ultimately making it indispensable for customers.

Regulatory Barriers

As I’ve already discussed somewhat, the Life Sciences industry is heavy on compliance and regulation due to the sensitive nature of the end products. This means building an increasingly compliant platform takes considerable resources and time. Even if a competitor developed the software quickly, they’d still need to get up to speed on the regulatory and compliance side, which gives Kneat a barrier to entry from new entrants.

Risks

The biggest risk I foresee for investors entering today is a slowdown in growth rates and an ensuing period of multiple contraction. Financials and valuation will be discussed further in part 2. However, the NTM EV/Sales ratio (I’m using a sales ratio here for now due to the company still running operating losses) has increased significantly over the last year, rising from a low of 5X back in 2023 to 9.5X today. While this is still lower than where the multiple was in 2022, it’s worth recognizing that the company was coming off a smaller revenue base in 2022 and putting up triple-digit growth quarters. Nonetheless, revenue growth accelerated in the previous 2 quarters to 45% and 52% respectively, up from 35% in the quarter before that, perhaps justifying a portion of the multiple increase.

On the business side, there is substantial reputational risk should Kneat fail to meet its compliance objectives for a customer. Thus, investing in Kneat requires some degree of trust that Kneat will be able to maintain its ability to keep the platform updated with constantly changing rules and regulations. Furthermore, any cloud-based software offering could be the target of bad actors such as hackers. This makes cybersecurity an important factor, particularly when there may be highly sensitive information involved in some of Kneat’s customer use cases.

There is, of course, technological risk (Kneat can’t fall behind on technology). Of particular interest right now would be how artificial intelligence (“AI”) may impact a business like Kneat. Could Life Sciences companies that are currently customers simply in-source and leverage AI to develop products to cut out Kneat? Or could Kneat use AI to its advantage to reduce its reliance on key programmers? At this stage, it remains to be determined how AI will impact software companies.

Part 2 is scheduled to be released by the end of January 2025. Stay Tuned!

ChatGPT 4o

Kneat 2023 Annual Information Form

Kneat November 2024 Investor Presentation

Various sources including ChatGPT 4o, Microcapclub, and unnamed sources.

Other Sources:

https://investors.kneat.com/

https://investors.kneat.com/financials/quarterly-financials

Thumbnail Image: ThisisEngineering

Very clean stuff, one of the best written and most detailed write ups I’ve seen so far! Looking forward to part 2!

Great write up. Would love to see veeva eventually buy this company